We Buy Houses In Connecticut

“Sell My House Fast For Cash”

★ No Fees ★ No Commissions ★ No Repairs ★ No Cleaning ★

Do you have a house or other type of real estate to sell in Connecticut? You can sell your house fast with our simple cash offer – we buy houses as-is with NO fees or repairs needed!

We pride ourselves on our transparency, getting sellers a fair cash offer; we buy Connecticut houses in any condition, whether it’s in physical disrepair or financial. You’re never under any obligation to accept our cash offer, and we don’t pressure anyone. We just want you to do what’s best for you, whether you sell your house fast to our cash house buyers, sell it to someone else or not even sell it at all. If you want to learn more about our nationwide experience and how we can help you, contact us at (860) 398-4472 or by filling out the short form that’s on our website.

At Next Door Properties, we buy houses across Connecticut and surrounding areas! We’re a veteran-owned and operated cash home buyer, so we serve our community with integrity and respect. Our homebuyers understand that when you need to sell your house fast for cash, the process should be simple. If you’re facing foreclosure, dealing with difficult tenants, or need to sell quickly, we’re here to buy your house. Trust is essential to us, and we prioritize open communication to ensure you receive a fair cash offer! If you’re ready to sell your house fast in Connecticut, contact us at (860) 398-4472!

Company That Buys Houses In Connecticut

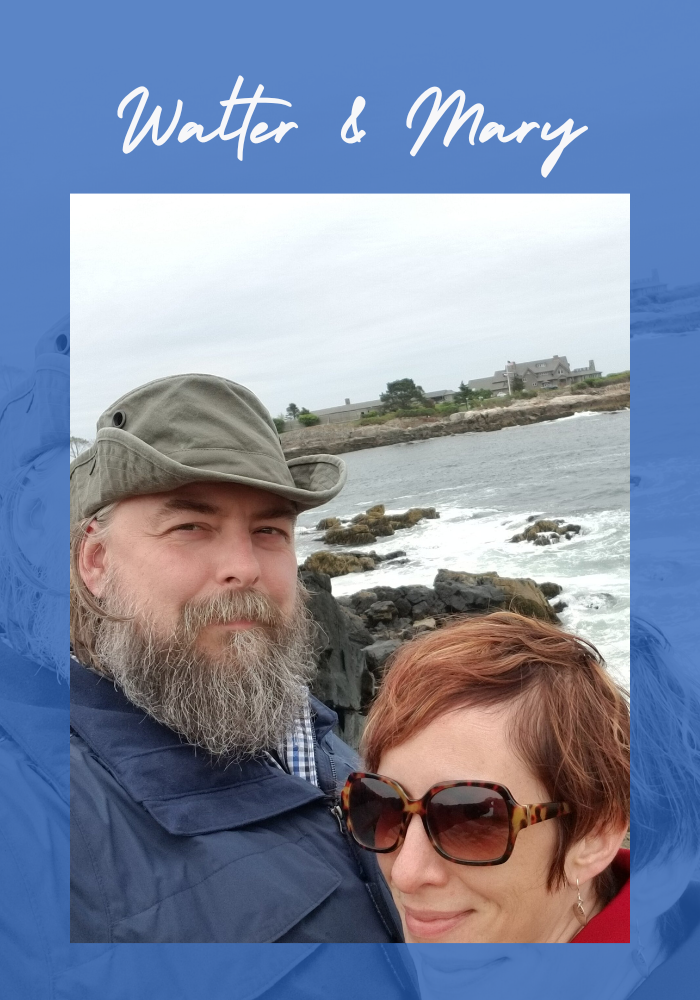

Hi there! We’re Walt and Mary from Next Door Properties, your trusted cash-for-houses company that buys properties across Connecticut! After years of serving our community, we found our true calling: helping homeowners sell their house fast. Together, we’ve built Next Door Properties to be Connecticut‘s most trusted cash home buyers!

Our process is simple and fast, we pay for all closing costs and get you the best market price when you sell your house as fast as you need us to buy.

We’ve combined our experience to make selling your house quickly possible. Want to sell your house fast for cash? That’s exactly what we do! As local cash buyers, we understand every situation is unique. That is why we offer personalized solutions when we buy from people facing foreclosure, bankruptcy, debt, and inherited properties. We buy houses fast in any condition! Plus, we handle everything, including paperwork, once we buy your house. We can close in as little as 7 days when you sell your house to us!

"*" indicates required fields

We Buy Homes In Connecticut In Any Situation

Did you know that as of January 2024, 32% of house sales are cash purchases? More Connecticut homeowners choose cash buyers to buy their houses because they’re tired of the traditional real estate headaches. At Next Door Properties, we buy houses fast with a simple promise: absolutely no stress when you sell! Our local cash home buyers focus on one goal. That is getting you the best cash offer for your house when you sell. All while making the process easy as we buy your house. Common Situations We Help With Are:

Avoiding Foreclosure

Dealing with mortgage problems or tax liens? Sell your house fast and we’ll help stop foreclosure auction with our quick cash offer.

Too Many Repairs

Don’t let renovation costs drain your savings. We buy houses for cash in Connecticut in any condition.

Job Relocation

Thinking about selling to relocate? We buy houses fast with cash so you can start your next chapter. Get paid quickly now!

Going Through A Divorce

Need a fast solution during divorce? We’ll help you sell quickly and split the equity so you can move forward with money in your pocket.

Tired Landlord

Stressed about tenant problems and rental property repairs? Let us buy those investment headaches today!

Inherited A House

Got a probate property you need to sell? We buy houses fast and pay cash for your inherited house.

We don’t stop there! Our professional home buyers love unique challenges. Got a duplex or condo that needs TLC? A mobile home you need to sell quickly? Land that’s just sitting empty? Or even commercial properties gathering dust? We buy houses fast and all types of real estate across Connecticut. We offer a simple cash sale once you decide to sell with us!

How Do I Sell My House Fast In Connecticut

Looking to sell fast in Connecticut? The quickest way to sell your house is through experienced cash home buyers like Next Door Properties. We’ve helped many Connecticut homeowners get cash for their houses when they’re ready to sell. Our deep understanding of the local real estate market ensures you’ll get a fair cash offer when you sell your house to us. Sell Your House Fast In 3 Simple Steps:

Step 1

Contact Us!

Just fill out our quick form or call (860) 398-4472. Tell us about your house and we’ll buy it with a personalized cash offer today!

Step 2

Get Your Offer!

We’ll present you with a fair cash offer within 24 hours! No pressure, no gimmicks – only a clear discussion about your options.

Step 3

Get Your Cash!

You pick the closing date! We work on your timeline and make sure you walk away with cash in hand. No financing delays!

Our process when we buy houses at Next Door Properties is refreshingly different. You won’t find any iBuyers or distant flippers here when you sell. Instead, you’ll work directly with our local team who knows every Connecticut neighborhood. We buy houses fast across the state and bring a personal touch once you’re ready to sell. We don’t use automated valuations when we buy houses. We’re real people offering real solutions to sell your house. Our personalized approach leads to better cash offers! It doesn’t matter if you have liens, tax problems, or need to sell your house quickly. We can help you sell your house fast in Connecticut!

We Buy Houses Fast In Connecticut

Skip The Realtor Fees

Want to keep 100% of your house equity when you sell your house? Our cash home buyers make it possible! The traditional real estate market eats up your profits with agent commissions, MLS fees, and closing costs. But when you sell your house for cash to Next Door Properties, you’ll receive our exact cash offer at closing. Your local Connecticut cash buyers will handle the transaction once you sell with us!

Private Home Sales Only

Dreading those endless weekend open houses? We understand! As professional house buyers in Connecticut, we buy houses fast and privately. No staging is needed. No parade of strangers through your house in order to sell. Our team will schedule one quick visit to see your property. We’ll make our cash offer right after to make you sell faster. That’s it! A simple sale between you and our local cash home-buying company.

Leave The Work To Us

Got a house that needs repairs? Perfect! Sell it to us fast! We buy houses fast across Connecticut in any condition. You don’t need to clean a single room once you sell. No repairs are required. No yard work is necessary, too. Our cash buyers love taking on projects after you sell to us. Pack only what you want to keep. We’ll tackle everything else! Your stress-free cash sale awaits with Connecticut‘s trusted house-buying professionals.

Sell Your House In Connecticut As-Is

We know how stressful it is thinking about all of the things that you must rectify in order to sell your house with a real estate agent or on your own – i.e. in an FSBO manner. That’s one of the main reasons why we buy houses in as-is condition and without you needing to do anything when you sell your Connecticut house for cash to us except walk out the door. Here are 6 advantages that you’ll get to enjoy if you sell your property for cash to Next Door Properties in as-is condition.

No Commissions Or Fees

Traditional real estate agents charge 6% plus closing costs. When you sell your house for cash in Connecticut, you keep more equity – no hidden expenses.

Close When You Want

Need to sell your house fast for a job relocation? Facing foreclosure deadlines and ready to sell? Our professional house buyers work on your schedule, not ours. You pick the closing date.

Private House Sale

Tired of endless property showings? Our local cash buyers make selling easy. No open houses. No business hours to coordinate. We promise a private transaction.

Fast Sale

Most properties take months to sell through MLS listings or FSBO. Our simple process includes a free title check and a quick timeline. Close in days!

Competitive Cash Offer

Real estate investors know market values in a specific area. As trusted cash home buyers in Connecticut, we analyze local sales data to ensure your quick cash offer beats those iBuyer quotes.

No Repairs Needed

We buy houses fast in any condition across Connecticut. Skip the renovation loans and contractor quotes! Our experienced team handles all repairs after purchase.

Cash For My House In Connecticut

No Need To Clean Or Make Any Repairs!

At Next Door Properties, we buy Connecticut houses in all types of situations and purchase all kinds of Connecticut real estate with our cash payments. Other property types in Connecticut that many sell to us include condos, duplexes, townhouses, mobile homes, and even completely undeveloped land.

Regardless of what kind your Connecticut real estate is, its condition, and its location, you can sell it to us.

Advantage Of Selling Your House To A Company That Buys Houses In Connecticut

We know how heavy this burden is, to have a house that you must sell due to issues with it or for unrelated reasons. Allow us to remove that burden and take care of the heavy lifting with our fast cash. Leave that broken refrigerator inside and broken. Allow us to handle it too once we buy your Connecticut house with our money. But it’s not just the physically heavy things that we take care of when you sell your house to us for cash. We also help with so many of the mental burdens, such as foreclosure threats, tax liens and similar types of financially challenging situations.

Time for a quick cash offer! As trusted cash home buyers in Connecticut, we help homeowners sell their houses fast. Say goodbye to realtor commissions. Skip those expensive repairs. Cancel those FSBO listings and for sale by MLS fees. Our company buys houses directly. You’ll never deal with mortgage approvals or financing delays. Need to sell your property before foreclosure? Have tax liens piling up? Our professional cash buyers will close on your schedule. Connecticut sellers love us because we put more equity in their pockets! If you’d like to learn more details about how you can sell your house fast to us for cash, fill out our form or give us a call.

"*" indicates required fields

Areas We Buy Houses In Connecticut

Regardless of where your house is located, we have you covered as we buy houses everywhere.

Call us 🤙(860) 398-4472

Sell My House Cash Connecticut

• Connecticut

• Ansonia

• Avon

• Berlin

• Bethel

• Bloomfield

• Branford

• Bridgeport

• Bristol

• Brookfield

• Burlington

• Canton

• Cheshire

• Clinton

• Colchester

• Coventry

• Cromwell

• Danbury

• Darien

• Derby

• East Hampton

• East Haven

• East Lyme

• Ellington

• Enfield

• Fairfield

• Farmington

• Glastonbury

• Granby

• Greenwich

• Griswold

• Groton

Sell My House Fast Connecticut

• Guilford

• Hamden

• Hartford

• Killingly

• Ledyard

• Madison

• Manchester

• Mansfield

• Meriden

• Middletown

• Milford

• Monroe

• Montville

• Naugatuck

• New Britain

• New Canaan

• New Fairfield

• New Haven

• New London

• New Milford

• Newington

• Newtown

• North Haven

• Norwalk

• Norwich

• Old Saybrook

• Orange

• Oxford

• Plainfield

• Plainville

• Plymouth

• Portland

Cash Home Buyers Connecticut

• Ridgefield

• Rocky Hill

• Seymour

• Shelton

• Simsbury

• Somers

• Southbury

• Southington

• Stafford

• Stamford

• Stonington

• Stratford

• Suffield

• Tolland

• Torrington

• Trumbull

• Vernon

• Wallingford

• Waterbury

• Waterford

• Watertown

• West Haven

• Weston

• Westport

• Wethersfield

• Wilton

• Winchester

• Windham

• Windsor

• Windsor Locks

• Wolcott

• Woodbury

Sell Your House For Cash In Connecticut FAQ’s

“How do I know if my cash offer is legit?”

Look for three key signs of a trustworthy cash home buyer who offers quicker home sales. First, legitimate cash companies like Next Door Properties always view your house before making a cash offer. Second, real cash buyers provide proof of funds and substantial earnest money deposits ($5,000+) when you sell. Third, professional house buyers use simple contracts without financing.

“What is the fastest way to sell a house?”

Cash buyers provide the quickest path to closing. Our local real estate investors can buy your house in days, not months. Skip the listing delays and get cash for your property now!

“Are companies that offer cash For houses legit?”

Most cash home buyers run reputable businesses. Check their Google reviews, verify their Better Business Bureau status, and read testimonials from past sellers before you let them buy your house. Next Door Properties maintains a 5-star rating because we deliver on our promises to homeowners.

“What Are the Pros and Cons of an All Cash Offer?”

There are several pros and cons to consider as you decide whether or not to sell your house for cash.

Pro #1: Low Risk Of The Deal Falling Apart

Recent data shows that 14.9% of traditional house purchase agreements that were under contract in June 2022 have failed. Our cash offers eliminate this risk when you sell! As direct cash buyers in Connecticut, we won’t rely on bank approvals or third-party financing when you sell your house to us.

Pro #3: Immediate Cash Access

Need quick funds for your next move? Our cash offer when you decide to sell your house to us puts money in your account fast. Perfect for job relocations, divorce situations, or inherited properties needing quick house sale solutions.

Con #1: Potentially Lower Offer

Market research shows cash offers average 10% below traditional sale prices. We offset this by eliminating all fees, commissions, and repair costs.

Pro #2: Lightning-Fast Closing

Traditional house sales take 60-90 days. Our cash home buyers can close in 7 days when you sell your house! No mortgage delays. No endless paperwork. Sell your house fast in Connecticut now with a competitive offer.

Pro #4: Skip The Extra Steps

Sell your house without appraisals or formal inspections. Our professional cash buyers eliminate these traditional house sale headaches. No repair requests. No financing contingencies. Sell through a simple cash transaction with us!

Con #2: Watch For Hidden Costs

Many iBuyers charge “service fees” up to 13% of your sale price. At Next Door Properties, our cash offer is exactly what you’ll receive – no surprise fees ever!

Maybe you still have a few questions. Don’t hesitate to contact us if all of your questions are not answered.

The Easiest Way To Sell Your House In Connecticut

When you need a trusted cash home buyer, our professional team stands ready with real solutions. We’ve simplified the entire process when we buy houses. No more realtor commissions and absolutely no financing delays. Our local cash buyers have helped countless homeowners escape foreclosure, solve tax liens, and turn inherited properties into quick cash opportunities. This proven track record shows why Connecticut sellers trust us to buy their house!

Don’t let the traditional real estate market hold you back another day. While other iBuyers offer automated lowball quotes when they buy houses, our experienced team brings honest cash offers to every transaction. We buy houses across every Connecticut community. Ready to experience the easiest way to sell your house? Join thousands of satisfied homeowners who’ve discovered the Next Door Properties difference. Your cash offer is just one simple step away! 🏡

"*" indicates required fields

We buy houses across Connecticut. If you need to sell your house fast for cash, we promise to make you a fair, no-obligation, no-hassle offer. Take it or leave it. You’ve got nothing to lose. Contacting us could be the best decision you make all week! 🙂 (860) 398-4472